Ever wondered what your future holds? The answer lies in your financial plan. A financial plan is the first step toward achieving your long-term goals—whether it’s buying a home, funding your child’s education, or preparing for retirement.

It all depends on the choices you make today. If you’re unsure about your goals or how to create a plan, here’s a practical guide to help you start your journey toward financial freedom!

Goals of Financial Planning

Financial planning goes beyond managing money; it focuses on securing your financial future.

Managing Cash Flow

Understand your income and expenses to control spending and improve overall financial stability effectively.

Preparing for Unexpected Risks

Stay calm during emergencies by having a financial plan as a safety net.

Supporting Investments

A solid plan opens opportunities for investing in stocks, property, or other assets that generate passive income.

Meeting Tax Obligations

Accurate financial planning ensures timely and stress-free tax compliance.

Preparing for Retirement

Secure a comfortable future by saving or investing early for long-term goals.

Purchasing Valuable Assets

Strategic financial planning simplifies acquiring significant assets like homes or vehicles, which can also be investments.

The Impact of Ignoring Financial Planning

Financial Gaps

Without proper planning, covering basic needs like bills and living expenses becomes challenging, leading to imbalances.

Accumulating Debt

A lack of financial strategy often results in reliance on credit cards or loans, increasing the risk of debt.

Financial Stress

Unmanaged finances can cause anxiety, affecting mental well-being.

No Emergency Funds

Sudden financial crises become harder to handle without savings.

Missed Financial Goals

Achieving long-term goals like home ownership or retirement becomes unattainable without clear planning.

Missed Investment Opportunities

Poor planning can lead to lost chances for wealth growth through investments.

Retirement Struggles

Insufficient savings can jeopardize a secure retirement.

Financial Instability

Economic fluctuations can destabilize daily life and future plans.

Mental Health Challenges

Prolonged financial stress can harm mental and emotional health.

Inability to Help Loved Ones

A lack of resources may hinder supporting those in need.

Steps to Create Effective Financial Planning

With Financial Experts

- Share your monthly income.

- Set clear financial goals.

- Detail monthly expenses.

- Discuss priorities and solutions.

- Receive a customized plan.

DIY Approach

- Analyze income and expenses.

- Set short-, mid-, and long-term goals.

- Allocate funds for essentials, investments, and emergencies.

- Monitor and evaluate plans monthly for consistency.

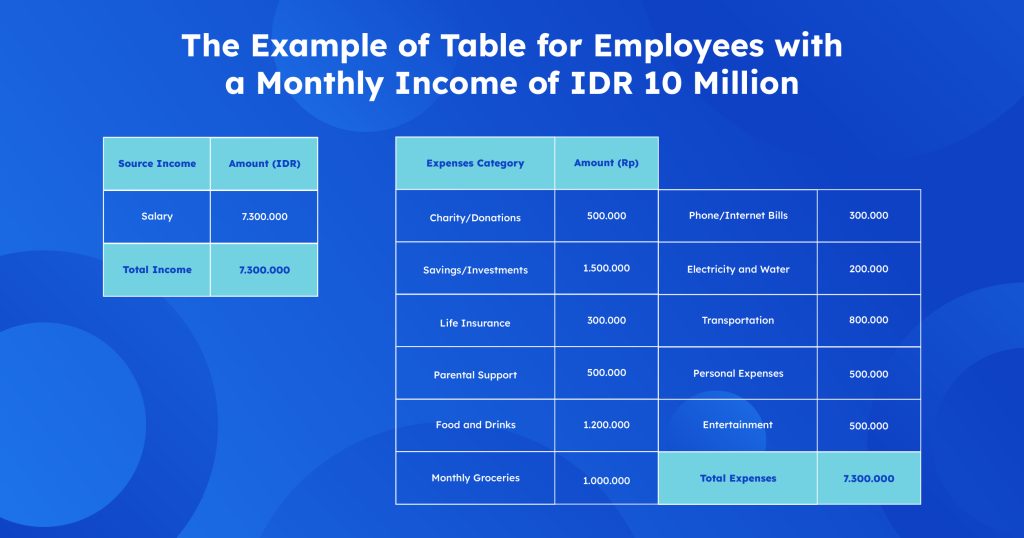

Example Financial Planning Table

Table for Employees with a Monthly Income of IDR 7.3 Million

INCOME

Empower Financial Independence with Flexible Salary Access

Setlary offers a flexible solution for employees, enabling instant access to their earnings without waiting for payday. Take advantage of the Special Christmas Discount: enjoy 50% off service fees for salary withdrawals from December 21 to 30.

Withdraw your salary now and save 50%!